Keep in mind that an invoice can be sent before the job is completed. If used properly, it can avoid overdue payments altogether.

Unpaid invoices full#

This solution essentially establishes a subscription option that allows clients to keep their accounts paid in full for your regular service.Īn automated invoicing system is ideal for those who perform a recurring service for their customers, such as writers and other freelancers. If you perform regular service for a customer, it could be wise to set up automated or recurring payments. Best of all, it can improve your accounting process, saving you time and optimizing your cash flow.

Unpaid invoices software#

This software will also create a unique invoice number to be integrated with the customer’s existing accounting department and streamline its procurement process.

The software connects directly to your business bank account, ensuring that every payment is available as soon as possible. The Invoice2go app will remind your customer that payment is due and send notifications to remind them to submit payment.

Unpaid invoices professional#

These invoice templates can be adapted to include your unique company logo and give your business a more professional look. At Invoice2go, a company, we offer digital solutions that allow you to create customized invoices and send them to your clients right from your smartphone. Your entire payment collection process can be streamlined using the latest invoice software. Having the ability to receive payment from these varied sources increases the likelihood that your clients will pay shortly after receiving your invoice. Your client may prefer to pay by cash, credit card, check, or a digital payment solution such as PayPal. You can reduce your outstanding invoices and ensure timely payment by offering your customers various payment options. A late invoice might be ignored by your clients, who may no longer view you as a priority. You’ll want to send the invoice to your customers immediately after you have delivered your goods or your services are complete. Remember, an invoice is nothing more than a payment request. Getting paid on time starts with sending an invoice on time. You’ll want to send your invoice to the company’s accounting department to ensure that the right person receives your invoice. But in larger organizations, your client may have a staff member in charge of billing and payments. If your customer is a sole proprietor, then you’ll be dealing with them directly. While you don’t have control over how your customers respond to your invoices, there are some strategies you can use to get paid promptly. The best way to prevent your outstanding invoices from becoming overdue is to get paid as soon as possible. If you do, you’ll be alerted to customers who have exceeded their due date. This distinction is why it’s important to keep track of your invoices.

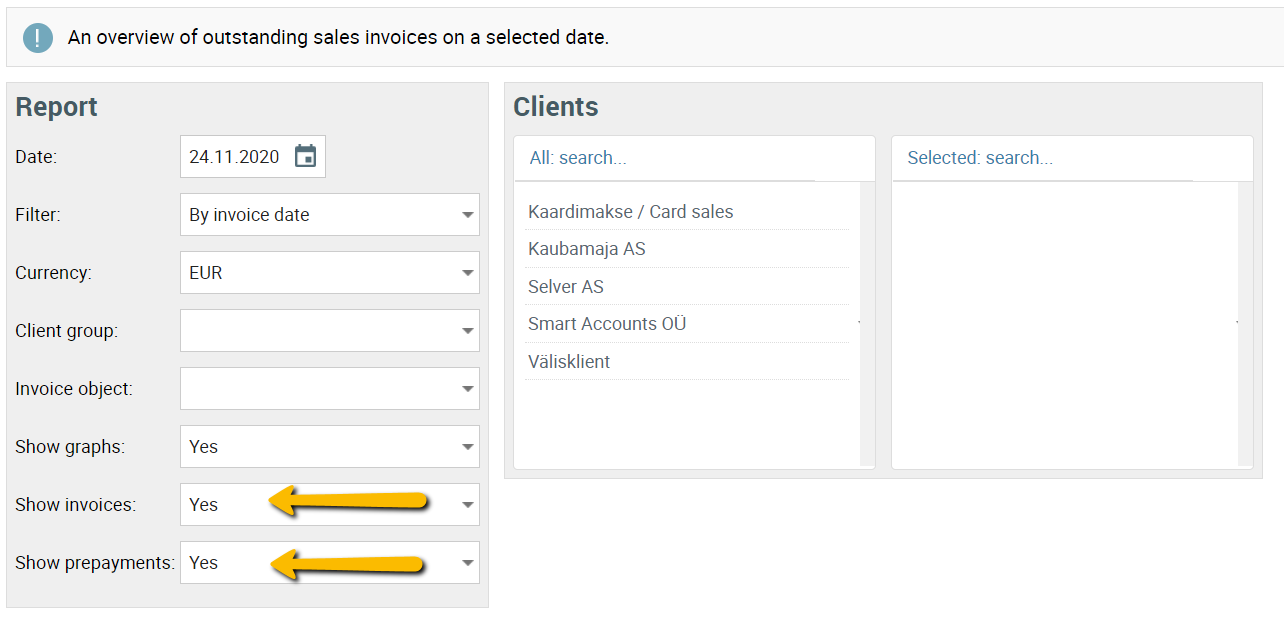

An outstanding invoice refers to an invoice that has been sent to a client who has not yet paid their balance.Īn outstanding invoice only becomes a past due invoice after the payment due date. While the terms are related, it’s important to understand that an outstanding invoice is not necessarily the same as a past due invoice. How can you avoid the pitfalls that come from outstanding and past due invoices? This article offers tips that can help you get paid on time and keep your business running smoothly. If you’re a small business owner, getting paid on time is essential to your financial health and success. That same study also showed that 82% of companies fail due to poor cash flow management. Bank, small businesses are owed an estimated $825 billion in unpaid invoices. Many small businesses indeed fail, but the blame doesn’t entirely lay with their owners.

0 kommentar(er)

0 kommentar(er)